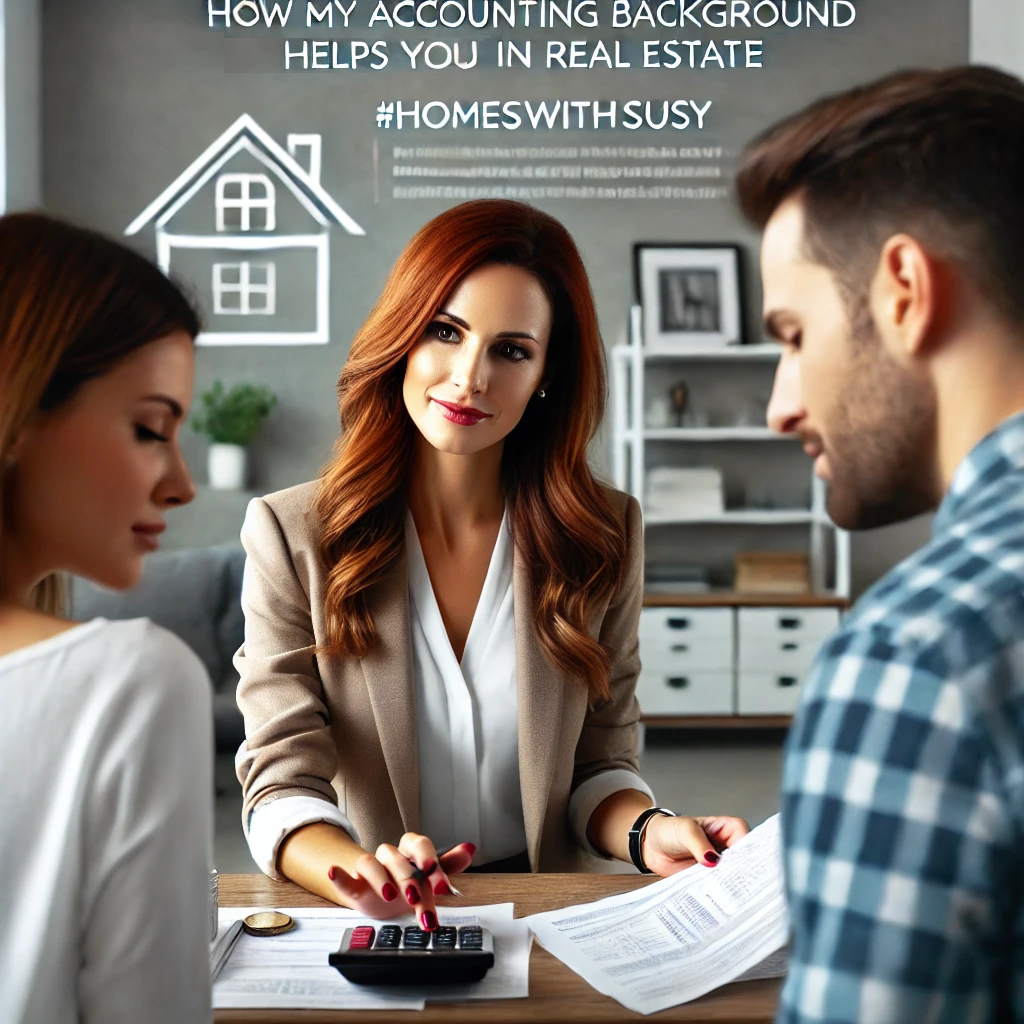

When it comes to buying or selling property, having a knowledgeable real estate agent on your side is essential. But what if your agent could also guide you through the financial complexities of real estate transactions with the expertise of a seasoned accountant? With 30 years of experience in private accounting, specializing in payroll and taxes, I bring a unique advantage to my real estate clients.

Here’s how my accounting background benefits you:

- Understanding Property Taxes and Financials

- Calculating Accurate Home Values

- Negotiating the Best Deals with Numbers in Mind

- Assisting with Investment Properties and ROI Calculations

1. Understanding Property Taxes and Financials

One of the most critical aspects of any real estate transaction is understanding the financial implications, especially when it comes to property taxes. Whether you’re buying a home or selling one, property taxes can affect your bottom line in significant ways. As someone who has worked extensively in tax preparation and analysis, I can help you navigate these complexities.

- For Buyers: I’ll break down the property tax history of potential homes, helping you understand how future tax rates might impact your budget.

- For Sellers: I’ll guide you in understanding capital gains taxes and any potential deductions, ensuring you’re well-prepared for tax season after the sale.

By focusing on these details, I can help you avoid any surprises and make informed decisions.

2. Calculating Accurate Home Values

Determining the right price for a home—whether you’re buying or selling—requires more than just a comparative market analysis. With my accounting experience, I’m skilled at analyzing numbers and considering factors that many overlook, such as cost of ownership, appreciation rates, and long-term return on investment.

- For Sellers: I’ll help you establish a fair and competitive asking price based on both market trends and detailed financial insights.

- For Buyers: I’ll evaluate whether the asking price aligns with the true value of the home and provide financial projections, helping you avoid overpaying.

My goal is to ensure that you get the best possible deal, with no hidden financial risks.

3. Maximizing Investment Potential

Real estate is often one of the biggest investments you’ll make, and it’s important to understand the long-term financial implications. Whether you’re looking to invest in rental properties, flip houses, or simply make a sound home purchase, my expertise in accounting can help you evaluate the return on investment (ROI).

- Investment Property Guidance: I’ll help you analyze rental income potential, expenses, and cash flow, ensuring the property aligns with your financial goals.

- Flipping Homes: I’ll work with you to calculate rehab costs and potential resale values, so you can maximize profits while minimizing risks.

- Primary Residence Purchase: I’ll provide long-term financial forecasts, considering factors like appreciation, interest rates, and future market conditions.

By taking a numbers-driven approach, I can help you make smarter, more informed investment decisions.

4. Financial Planning and Mortgage Guidance

The process of securing a mortgage can be overwhelming, but my experience in payroll, budgeting, and financial planning allows me to assist in understanding what you can truly afford. From evaluating mortgage options to planning for your monthly payments, I’ll guide you through the financial steps to homeownership.

- Mortgage Affordability: I’ll help you assess your financial situation, ensuring that your mortgage fits comfortably within your budget.

- Budgeting for Homeownership: I’ll provide insights into managing ongoing expenses like utilities, maintenance, and taxes, ensuring that your new home remains a sound financial choice.

By offering practical financial advice, I can ensure that your real estate investment is sustainable for the long term.

5. Negotiating the Best Deals with Financial Insights

Real estate negotiations can be stressful, but with my background in accounting, I can approach every deal with a sharp focus on the numbers. Whether negotiating a purchase price, closing costs, or contract terms, my ability to analyze financials will work to your advantage.

- For Buyers: I’ll identify opportunities to negotiate on price, repairs, or seller concessions, ensuring that you get the best deal possible.

- For Sellers: I’ll ensure that your home is competitively priced and help you negotiate offers that meet your financial goals.

By focusing on the financial side of negotiations, I can help you come out ahead, whether you’re buying or selling.

Conclusion: More Than Just an Agent

In real estate, it’s not just about finding a home; it’s about making a sound financial investment. My 30 years in accounting, combined with my real estate expertise, allow me to provide a unique, well-rounded service to my clients. Whether you’re buying your first home, investing in property, or selling a beloved home, I’ll be by your side, not just as your real estate agent, but as your financial advisor, ensuring that every decision you make is grounded in financial expertise.

If you’re ready to work with an agent who understands the numbers behind the transaction, contact me today!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link